Digilence Now Fully Integrates with SafeSend Returns

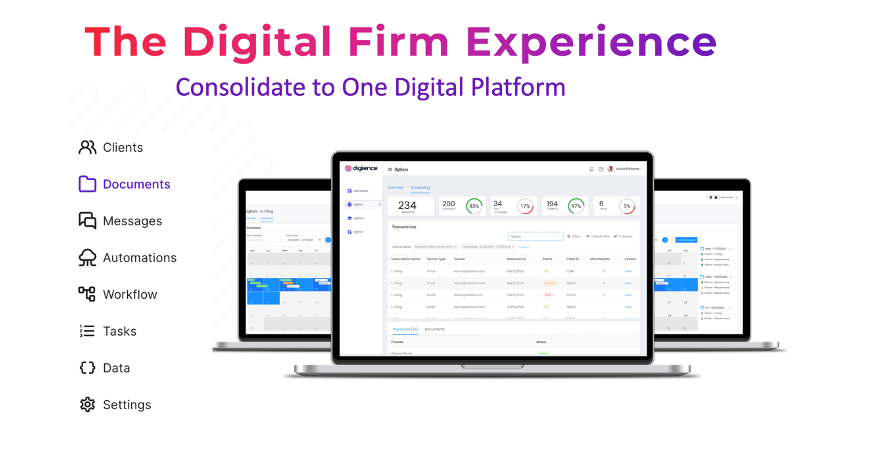

The Digilence partnership with SafeSend Returns enables accounting firms to seamlessly integrate SafeSend’s tax return delivery platform with Digilence’s SaaS AI platform for automated tax e-file workflow, creating a seamless offering for tax departments of all sizes.

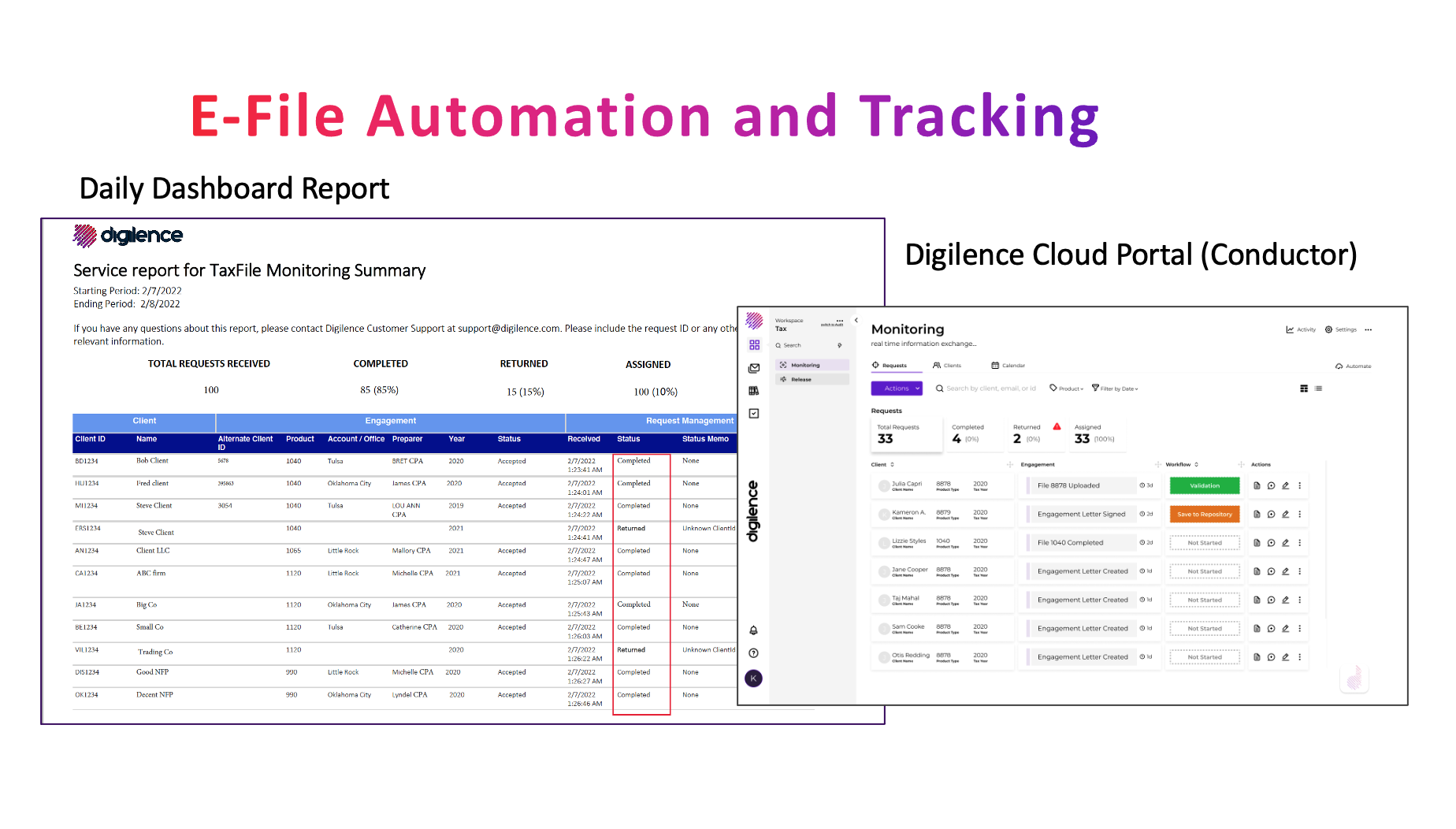

Once the tax return is e-signed through SafeSend Returns, it seamlessly and securely routes to the Digilence Cloud for automated completion of the tax e-filing process and IRS acceptance tracking, saving 50% - 80% of the related tax processing time.

Last-Mile Tax Automation Landing Site

Digilence and SafeSend formed a partnership that will deliver seamless integration between SafeSend Returns® and the Digilence Cloud SaaS automation for off-the-shelf automations of Tax operations. The integration will allow accounting firms to leverage both platforms as a single streamlined solution for complete last-mile-of-tax automation.

The combined offering has the potential to triple a firm’s ROI by integrating the capabilities of SafeSend Returns and the Digilence Cloud while minimizing implementation obstacles and complexities. SafeSend Returns is the profession leader for the assembly, delivery and e-signature of completed tax return packages. The Digilence Cloud picks up where SafeSend Returns leaves off by automating a firm’s remaining pain points once a tax return is e-signed, including automation of e-file release, IRS acceptance and rejecting tracking, document management updates, and workflow updates to close the engagement. This eliminates countless hours of manual, repetitive effort for tax departments.

The Digilence Cloud takes each signed tax return package, completes additional validations of 8879s and all state authorization forms, and saves them automatically to the firm’s internal systems. Digilence then automatically executes the e-filing with the IRS, monitors the acceptance results, and performs all the back-office steps to update workflow and document management systems.

“The SafeSend Suite is in use by more than 50 percent of the Top 400 accounting firms, and those customers rely on them for automating the touchpoints between the firm and the client along the tax preparation engagement” said Loren Eckart, Co-Founder of Digilence. “We are proud to partner with SafeSend and look forward to integrating our suite of AI and automation products in a way that accelerates the digitization of accounting processes for our mutual customers.”

“As a customer of both SafeSend Returns and Digilence, this partnership is a logical evolution in tax automation and is aligned with our firm’s objective to be on the forefront of the digital curve,“ said Barry Brown, COO of Moore Stephens Tiller. “SafeSend and Digilence are top examples of a new wave of “digital-first” vendors that are addressing the age-old manual processes that still plague this industry. I’m confident that the two of them together will push the envelope to further digitize the tax engagement and help firms transform the experience inside and out for today’s Digital CPA.”

“We’re passionate about helping this industry embrace digital and leverage emerging technologies, but everyone is struggling to figure out where to start and how to scale capability,” added Loren Eckart. “We have changed the game with our SaaS approach by packaging all cognitive technologies in a way that is productized for this industry and therefore accessible, affordable, accurate and turnkey for the firm. Our offerings provide ubiquitous automation and can help firms transform with the many other tax, audit, and back-office products coming soon from Digilence”.