Digilence integrates with Thomson Reuters: Unleashing the Power of Digital Intelligence for Tax Practices

Discover how the Digilence Cloud leverages digital intelligence and artificial intelligence for accounting firm customers using Thomson Reuters solutions.

Digilence Integrates with Thomson Reuters GoSystemTax, GoFileRoom, and FirmFlow.

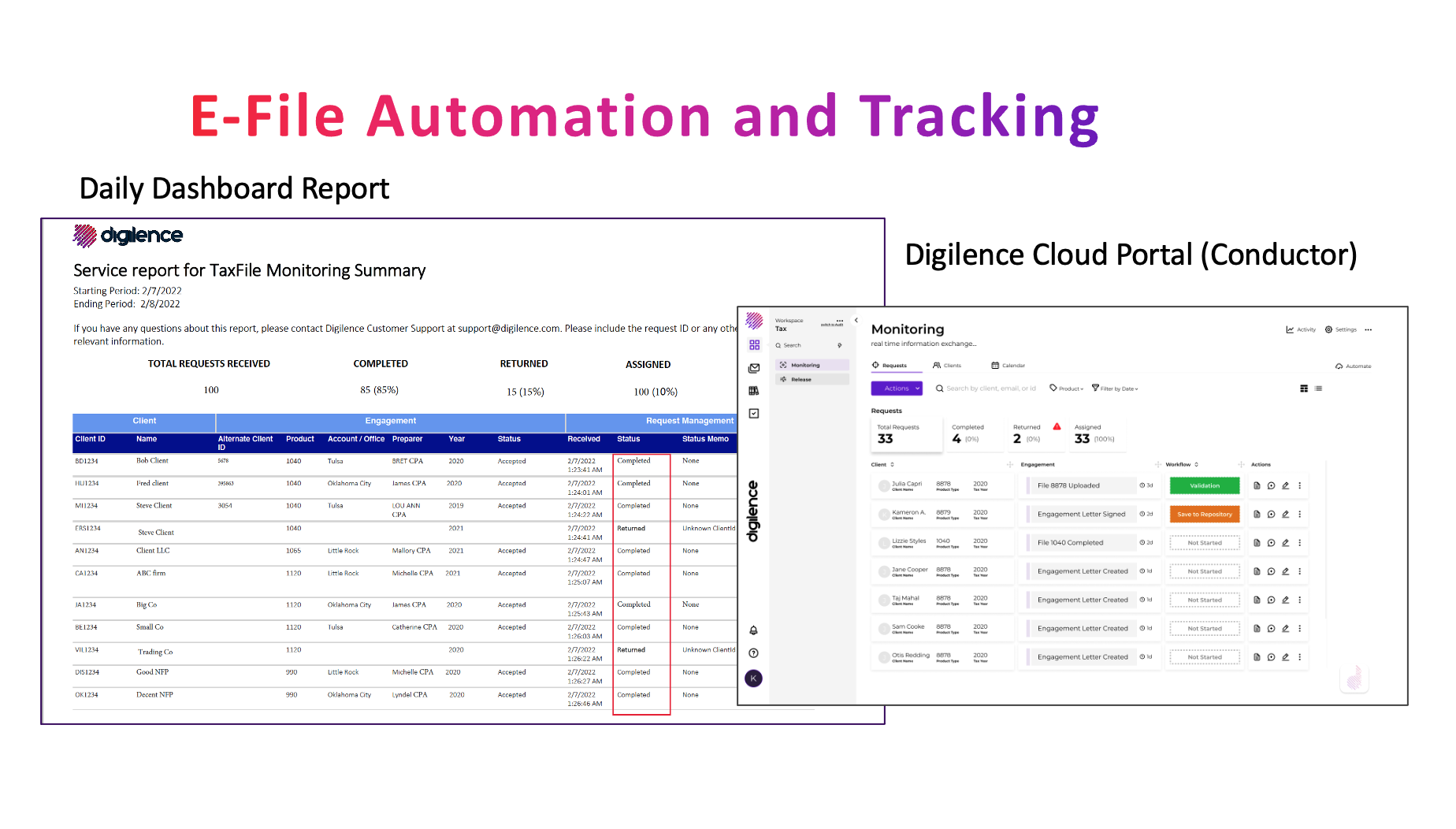

As Thomson Reuters customers strive to streamline their engagement operations, they are turning to the power of APIs and automation. Digilence, a SaaS provider of innovative digital intelligence solutions, is leading the way in leveraging cloud integrations and open API technology to automate time-consuming compliance processes across multiple systems used by leading accounting firms. The Digilence Cloud now seamlessly integrates with Thomson Reuters systems, including GoTax, GoFile Room, and Firm Flow.

In its latest version, the Digilence Cloud introduces an integration Platform-as-a-Service (PaaS) called Symphony® that embeds third-party integration and APIs into a suite of Software-as-a-Service (SaaS) products. This integration allows accounting firms to automate processes, increase productivity, and deliver more value to their clients. With Digilence, firms can unlock new opportunities for growth and efficiency in today's competitive landscape in professional accounting.